Assets Loans

Asset & Vehicle Finance specialists

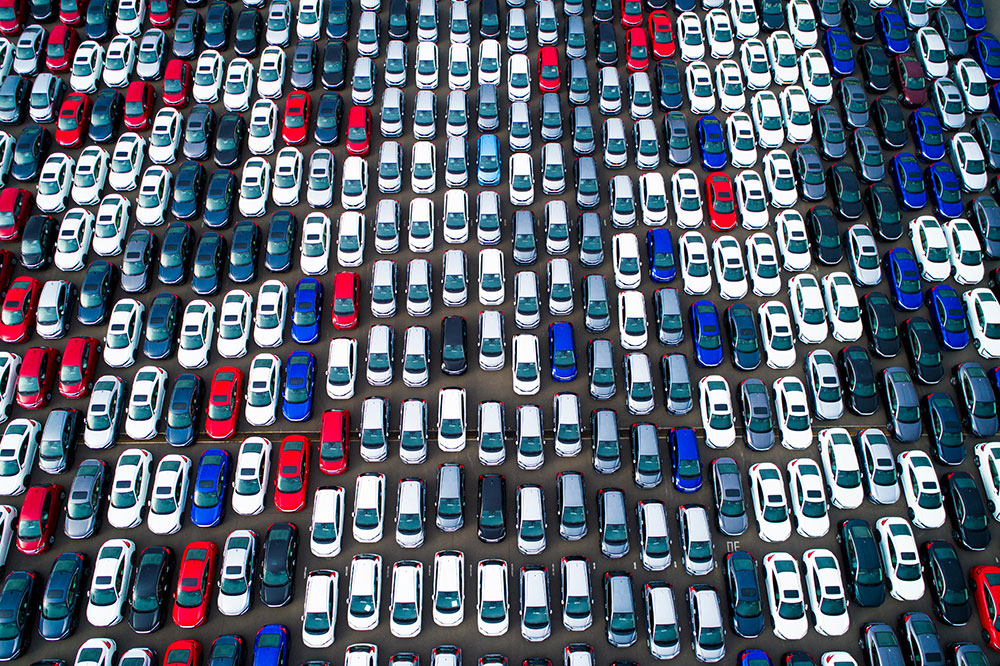

Whether you’re looking to purchase a new company vehicle, upgrade essential machinery, or finance heavy equipment, we provide tailored financing options to suit your budget and business needs.

A better deal might be only a few steps away

Asset & Vehicle Finance Services

Vehicle & Fleet Leasing

Equipment Finance

Machinery Finance

Asset & Vehicle Finance

Flexible asset finance solutions tailored to your business.

Purchasing equipment or upgrading your fleet doesn’t have to tie up capital or slow operations. Equipment Finance & Vehicle Leasing provides a cost-effective way to access the assets your business needs while preserving cash flow.

Specialist lenders and lease providers offer flexible terms, structured repayments, and tailored packages that suit your operational requirements. Whether you need a single vehicle or an entire fleet, we guide you through the application, approvals, and compliance requirements, ensuring you get the right solution quickly.

We can help optimise tax and cash flow benefits, manage ongoing renewals, and plan for future growth.

Vehicle & Fleet Leasing

Fleet solutions that drive your business forward

Leasing isn’t just about getting you from A to B, it’s a strategic way to manage cash flow, tax, depreciation, and operational efficiency. Yet many businesses owners’ default to using bank loans or dealer finance, missing the full spectrum of leasing solutions.

Operating leases offer predictable payments and easy fleet management without ownership concerns, while finance leases allow you to claim GST and depreciation benefits with optional balloon at term end. Novated leases can benefit employees through pretax savings advantages, and commercial fleet packages can consolidate multiple vehicles under one facility with scalable limits. Flexibility is key to optimising savings.

We assess your fleet needs, cash flow, and tax position, then match you with the right lease type and lender, negotiate terms, and handle all documentation.

Equipment Finance

Flexible asset finance solutions tailored to your business.

Investing in the right equipment or machinery may be critical to keeping your business productive and competitive. Yet financing these assets can be complex, with a wide variety of finance options, each offering different tax, cash flow, and ownership benefits.

Many business owners end up overpaying or tying up capital because they weren’t aware of their options. Specialist lenders provide tailored solutions so you only pay for what works for your business. Flexible terms, structured repayments, rent-to-own options and interest-only periods are often available to manage cash flow efficiently.

Our goal is to make the process simple, reduce administrative burden, and ensure your equipment funding aligns with both short-term cash flow and long-term growth.

TESTIMONIALS

What our clients say

Posted onTrustindex verifies that the original source of the review is Google. Super helpful team at Daoud Finance! They will help and walk you through each step of every process and are super efficient! 100% recommend!! Thank you!!😁Posted onTrustindex verifies that the original source of the review is Google. Working with Adel and the team has been nothing short of exceptional, even working on multiple purchases at one time. Highly recommend.Posted onTrustindex verifies that the original source of the review is Google. My experience with adel from daoud finance has been absolutely amazing! They made my loan for my ute happen in less then the expected time and hassle free. Will for sure be recommending and re using his services again!Posted onTrustindex verifies that the original source of the review is Google. Adel Daoud is the best person in this area’s to help you with your home loan,I would definitely recommend if you need any assistance with your home loans.Posted onTrustindex verifies that the original source of the review is Google. Excellent service would highly recommend. I was a first home buyer with Adel and I could not have asked for more from his service. He worked above and beyond to help me secure my first home. He answered all the frequent and annoying questions a FHB like me would have with haste and often did so after business hours.Posted onTrustindex verifies that the original source of the review is Google. Excellent experience with my broker. They were professional, responsive, and helped me secure a great interest rate with the bank. The entire process was smooth and stress-free. Highly recommended.Posted onTrustindex verifies that the original source of the review is Google. Adel from Daoud Finance was incredible to work with! As first-home buyers, my partner and I had a lot of questions, but Adel made the entire process smooth and stress free. He was always quick to respond and took the time to ensure we understood every detail. Even with our tight timeline, he went the extra mile to get everything sorted on time. We couldn’t have asked for a better experience. I’d highly recommend Adel to anyone looking for assistance with their loan!Posted onTrustindex verifies that the original source of the review is Google. We give the team at Daoud Finance our highest praises and recommendations. Adel assisted my partner and I in securing a loan for our first home, he made everything so much easier. He guided us through every step with patience and clarity, explaining things in a way we could actually understand. He was always available to answer our questions and kept us updated at every stage. We are grateful for his support and guidance through the whole process, and highly recommend any first home buyers.Posted onTrustindex verifies that the original source of the review is Google. Adding to this review: LOAN #4 GUYS, LOAN #4! Enough said. My review is simple, just settled on my third loan with Daoud Finance. Absolutely stellar people to deal with. I recommend them wholeheartedly.Posted onTrustindex verifies that the original source of the review is Google. I’ve been working with Adel and the team at Daoud Finance for over 4 years, and he has helped us buy our dream home in our dream location, I’m not sure we would have managed it without his guidance and support. I couldn’t be happier with the dedicated service they’ve provided us over the years. Every interaction has been professional, personalised, and focused on achieving the best outcomes for our goals. Their expertise has made what can often be a complex process, feel easy and seamless. They have always been there for us, guiding us through multiple property purchases, providing clear advice, tailored strategies, and exceptional service every step of the way. Their dedication and genuine care have built a level of trust that makes it easy to know my finances and investment decisions are definitely in the right hands. If you’re looking for a broker that combines experience, integrity, and outstanding results, you can’t go past Daoud Finance because they are simply an exceptional choice. Thank you to the Team at Daoud Finance.

FAQs

Frequently asked Questions

What is a mortgage broker?

A mortgage broker is your personal guide through the lending world. Instead of dealing with multiple banks yourself, we do the research, compare lenders, and find the right loan that fits your goals. We’re licensed professionals who act in your best interests, making the process simple, transparent, and stress-free.

Why use a mortgage broker?

Using a mortgage broker gives you access to a wide range of loan products from multiple banks and lenders, not just one. We take the time to understand your needs and goals, then present you with options so you can easily compare interest rates, repayments, and loan features. We handle the heavy lifting, researching, negotiating, and shortlisting the right loans so you don’t waste time dealing with lenders whose products may not suit you. A good broker can also save you money by helping you find the loan that fits your circumstances perfectly.

What makes Daoud Finance different?

Do Mortgage Brokers charge fees?

Mortgage brokers are generally paid by lenders through commissions, paid when a loan settles, often referred to as “success fees.” These commissions are usually set at industry-standard rates, ensuring recommendations are based on what suits your needs, not who pays more.

In some complex situations, a broker may charge a commitment or processing fee. If this applies, it will always be clearly explained and agreed upfront.

Brokers are required to act in their client’s best interests and operate under strict regulatory obligations. Transparency around fees and remuneration is a core part of responsible lending.

At Daoud Finance, we’re committed to being open and upfront about how we’re paid. Our advice is always focused on what’s best for you, and our business is built on trust, long-term relationships, and referrals from clients who value genuine guidance and care.